oregon tax payment system

Oregon Online Tax Payment System will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Oregon Online Tax Payment System quickly and.

Tax Comparison Sales And Income Oregon Office Of Economic Analysis

Oregon Tax Payment System will sometimes glitch and take you a long time to try different solutions.

. Oregons property tax system represents one of the most important sources of revenue for local governments. Corporate Income and Excise. EFT Questions and Answers.

If you did not receive an Access Code to reactivate your. Alternate schedules and holidays in eTime. Oregon Tax Payment System Oregon Department of Revenue.

Electronic payment using Revenue Online. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. EPayroll work charge and override helpful hints.

Oregon Department of Revenue - Payments. Part time alternate schedules and holidays in eTime. Marion County mails approximately 124000 property tax statements each year.

Your browser appears to have cookies disabled. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050. To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site.

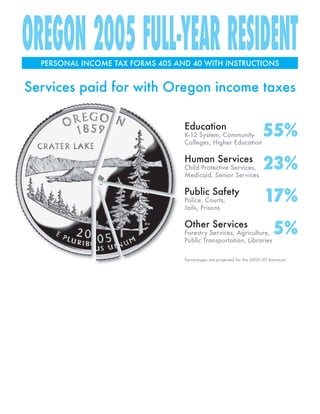

Choose to pay directly from your bank account or by credit card. The statements are mailed between. Oregons personal income tax is progressive but mildly so.

Marginal tax rates start at 475 percent and as a taxpayers income goes up rates quickly rise to 675 percent and 875. LoginAsk is here to help you access Oregon Tax Payment System quickly and. Washington County is one of these local governments that receives property tax.

You may use this Web site and. Cookies are required to use this site. Be advised that this payment application has been recently updated.

Service provider fees may apply. EPayroll direct deposit information. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows.

If you are signing in to your account for the first time please follow this link and use the Access Code sent to your business.

What Is The Oregon Transit Tax Statewide Local

6 Things To Keep In Mind About Oregon Taxes Oregon Center For Public Policy

Oregon Legislature Passes 1 Billion Tax Package Portland Business Journal

E File Oregon Taxes For A Fast Tax Refund E File Com

Exploring The Racist Roots Of The Oregon Tax System Opb

Oregon State Tax Information Support

Unique Tax System Keeps Oregon Weird In The Wrong Way Oregonlive Com

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Quarterly Tax Calculator Calculate Estimated Taxes

Pamplin Media Group How Much Income Tax Do Oregon Schools Get

Tax Alert Notice February 2020 Session Oregon Tax News

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

Oregon Gross Receipts Tax Is Now In Effect Our Insights Plante Moran

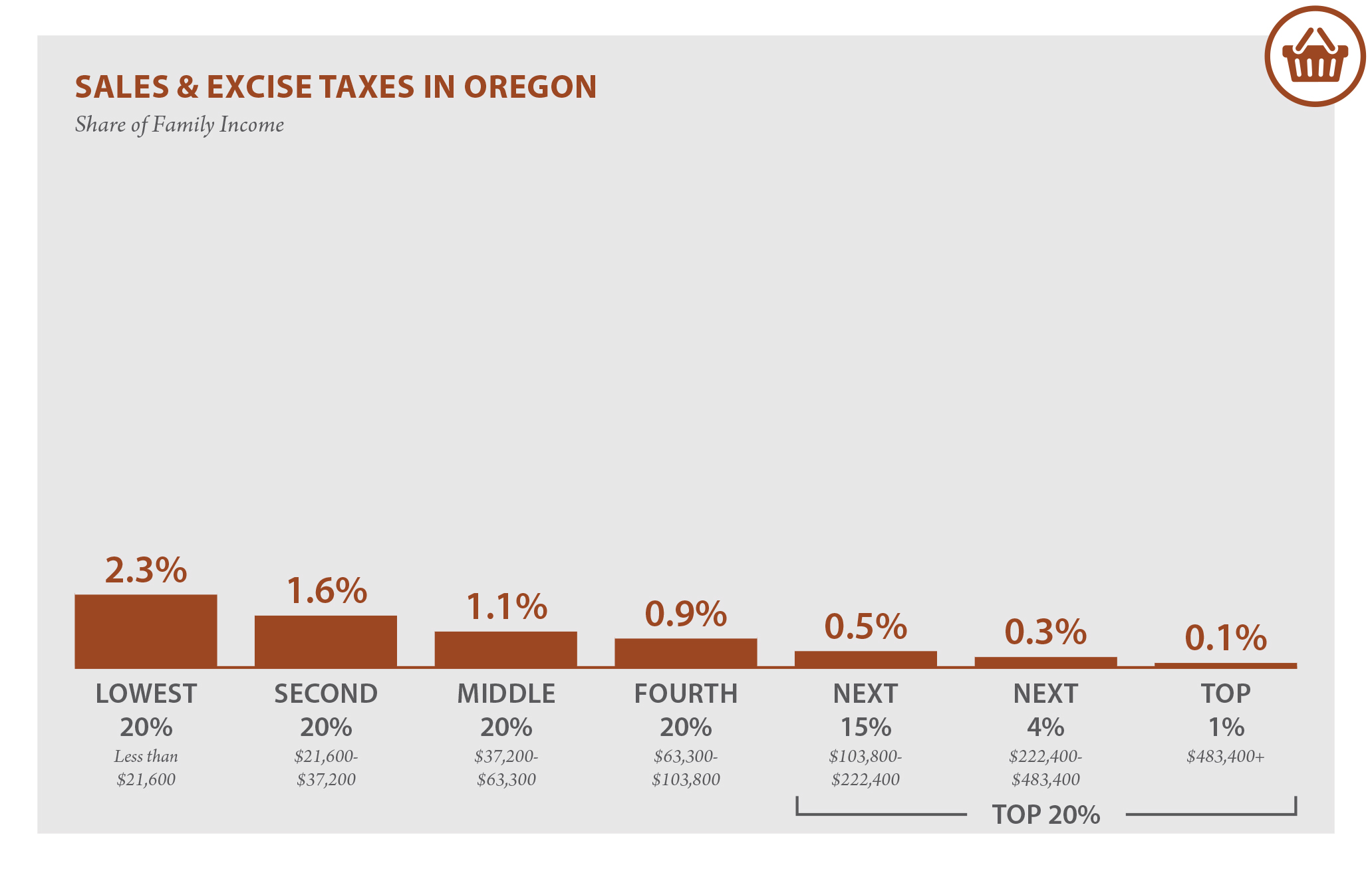

Oregon Who Pays 6th Edition Itep

Is My Income Non Taxable Do I Need To Pay The Tax Arts Tax Forms The City Of Portland Oregon

Pers Update Cost Concerns Pers Solutions And Saif Oregon Business Industry